One of my classmate in Fudan told me that he had a great performance in HK stock market in 2022, is it true? Where was his performance come from?

Let's find out with Brinson Model.

Before we started calculation, we have picked Heng Seng Index as our benchmark(cuz our portfolio traded at HK stock market). We also collected the four types of necessary data, they are...

- return of each sector of Benckmark

- weight of each sector of Benckmark

- return of each sector of Portfolio

- weight of each sector of Portfolio

Now we let our Python 🐍 do the job.

First import packages

import matplotlib.dates as mdates

import matplotlib.pyplot as plt

from google.colab import files, drive

import matplotlib as mpl

import pandas as pd

import numpy as np

try:

!gdown --id 1fsKERl26TNTFIY25PhReoCujxwJvfyHn

zhfont = mpl.font_manager.FontProperties(fname='SimHei .ttf') # make mpl show chinese

except:

passthen we import the data.

benchmark_and_portfolio = pd.read_excel('benchmark_and_portfolio.xlsx')

benchmark_and_portfolio['excess_return'] = (benchmark_and_portfolio.r_portfolio - benchmark_and_portfolio.r_benchmark).round(5)then we can do the calculation, here we use the BHB Model, instead of BF Model.

brinson_model = pd.DataFrame(columns=['date', 'sector', 'allocation_effect', 'selection_effect', 'interaction_effect', 'excess_return'])

brinson_model['date'], brinson_model['sector'] = benchmark_and_portfolio['date'], benchmark_and_portfolio['sector']

#allocation effect (bhb model)

brinson_model['allocation_effect'] = ((benchmark_and_portfolio['w_portfolio']-benchmark_and_portfolio['w_benchmark'])*(benchmark_and_portfolio['r_benchmark']))

brinson_model.loc[brinson_model['sector']=='Total', ['allocation_effect']] = brinson_model[brinson_model['sector']!='Total'].groupby('date').sum(['allocation_effect']).reset_index()['allocation_effect'].to_list()

#selection effect

brinson_model['selection_effect'] = ((benchmark_and_portfolio['w_benchmark'])*(benchmark_and_portfolio['r_portfolio']-benchmark_and_portfolio['r_benchmark']))

brinson_model.loc[brinson_model['sector']=='Total', ['selection_effect']] = brinson_model[brinson_model['sector']!='Total'].groupby('date').sum(['selection_effect']).reset_index()['selection_effect'].to_list()

#interaction effect

brinson_model['interaction_effect'] = ((benchmark_and_portfolio['w_portfolio']-benchmark_and_portfolio['w_benchmark'])*(benchmark_and_portfolio['r_portfolio']-benchmark_and_portfolio['r_benchmark']))

brinson_model.loc[brinson_model['sector']=='Total', ['interaction_effect']] = brinson_model[brinson_model['sector']!='Total'].groupby('date').sum(['interaction_effect']).reset_index()['interaction_effect'].to_list()

# excess return

brinson_model['excess_return'] = brinson_model[['allocation_effect', 'selection_effect', 'interaction_effect']].sum(axis=1)

# round to 5th digit

brinson_model = brinson_model.round(5)

# show

brinson_modelNow we get a beautiful Brinson Model DataFrame~

Before we further do the visualization, let's check our calculation with the excess_return data. Since the excess_return equals to

return of portfolio minus return of benchmark,

also equals to

allocation_effect add selection_effect add interaction_effect.

All we have to do is to verify this in our Brinson Model DataFrame.

# checking calculation

diff_of_excess_return = (brinson_model[brinson_model.sector=='Total'].excess_return - benchmark_and_portfolio[benchmark_and_portfolio.sector=='Total'].excess_return)

if diff_of_excess_return.mean() < 0.000001:

print('no calculation error')

else:

print('there is a calculation error')The result shows no calculation error, wonderful! we can do the visualization now.

we first plot the cumulative return of the portfolio and benchmark.

# cumulative return

cumulative_return = pd.DataFrame()

cumulative_return['date'] = benchmark_and_portfolio.date.unique()

cumulative_return['benchmark'] = round(((benchmark_and_portfolio[benchmark_and_portfolio.sector=='Total'].r_benchmark.reset_index(drop=True)+1).cumprod()-1),5).to_list()

cumulative_return['portfolio'] = round(((benchmark_and_portfolio[benchmark_and_portfolio.sector=='Total'].r_portfolio.reset_index(drop=True)+1).cumprod()-1),5).to_list()

cumulative_return['cumulative_excess_return'] = cumulative_return['portfolio'] - cumulative_return['benchmark']

# draw

week = cumulative_return.index

benchmark_return = cumulative_return['benchmark']*100

portfolio_return = cumulative_return['portfolio']*100

plt.figure(figsize=(12, 6))

plt.plot(week, benchmark_return, label = "benchmark")

plt.plot(week, portfolio_return, label = "portfolio")

plt.xlabel('week')

plt.ylabel('return (%)')

plt.legend()

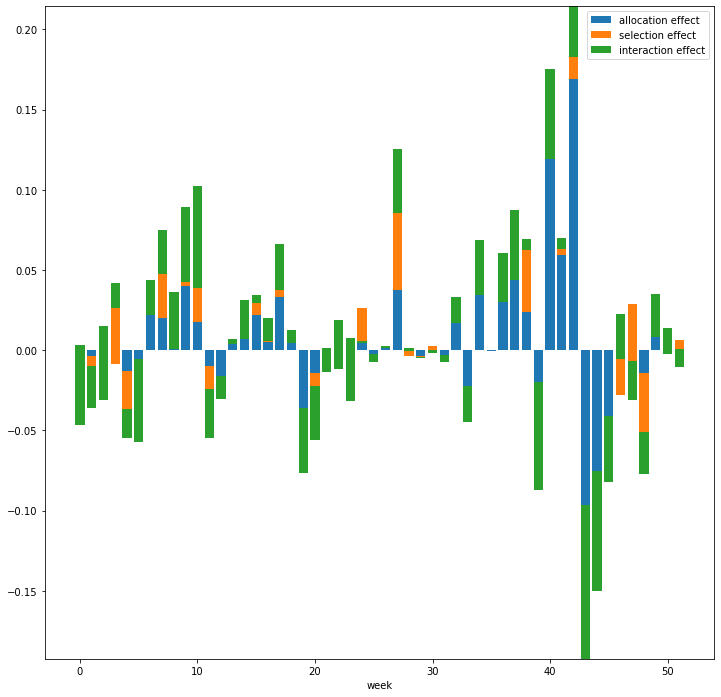

plt.show()Then we draw each effects in Brinson Model along our holding period, aka 2022.

# brinson period analysis

week = brinson_model[brinson_model.sector=='Total'].reset_index(drop=True).index

allocation_effect = brinson_model[brinson_model.sector=='Total'].allocation_effect

selection_effect = brinson_model[brinson_model.sector=='Total'].selection_effect

interaction_effect = brinson_model[brinson_model.sector=='Total'].interaction_effect

width = 0.4

plt.figure(figsize=(12, 12))

plt.bar(week, allocation_effect)

plt.bar(week, selection_effect, bottom = allocation_effect)

plt.bar(week, interaction_effect, bottom = allocation_effect+selection_effect)

plt.xlabel("week")

plt.legend(['allocation effect', 'selection effect', 'interaction effect'])

plt.show()Finally, we draw the average effects on each sector.

[# brinson sector analysis

brinson_sector_analysis = pd.DataFrame()

brinson_sector_analysis['sector'] = brinson_model.sector.unique()

brinson_sector_analysis['allocation_effect'] = np.nan

brinson_sector_analysis['selection_effect'] = np.nan

brinson_sector_analysis['interaction_effect'] = np.nan

brinson_sector_analysis['excess_return'] = np.nan

for i in range(len(brinson_model.sector.unique())):

s = brinson_model.sector.unique()[i]

allocation_effect = brinson_model[brinson_model.sector==s].allocation_effect.mean()

selection_effect = brinson_model[brinson_model.sector==s].selection_effect.mean()

interaction_effect = brinson_model[brinson_model.sector==s].interaction_effect.mean()

excess_return = brinson_model[brinson_model.sector==s].excess_return.mean()

brinson_sector_analysis['allocation_effect'][i] = round(allocation_effect,5)

brinson_sector_analysis['selection_effect'][i] = round(selection_effect,5)

brinson_sector_analysis['interaction_effect'][i] = round(interaction_effect, 5)

brinson_sector_analysis['excess_return'][i] = round(excess_return, 5)

pole = brinson_sector_analysis.sector.unique()

# Initialise the spider plot by setting figure size and polar projection

plt.figure(figsize=(15, 12))

plt.subplot(polar=True)

theta = np.linspace(0, 2 * np.pi, len(pole))

# Arrange the grid into number of sales equal parts in degrees

lines, labels = plt.thetagrids(range(0, 360, int(360/len(pole))), (pole), fontproperties=zhfont, fontsize=15)

# Plot actual sales graph

plt.plot(theta, (brinson_sector_analysis.allocation_effect*100).to_list())

plt.plot(theta, (brinson_sector_analysis.selection_effect*100).to_list())

plt.plot(theta, (brinson_sector_analysis.interaction_effect*100).to_list())

# Add legend and title for the plot

plt.legend(labels=('allocation effect', 'selection effect', 'interaction effect'), loc=0, fontsize=8)

plt.title("average effect by sector (%)", fontsize=20)

plt.show()](https://i.postimg.cc/ZK5TPpjD/3.png)Voila!!!